This Christmas, Remember Why You're Paying More for Less

The pandemic isn't responsible for inflation; the pandemic response is.

It was recently revealed in a LendingClub report that 60% of Americans are living paycheck to paycheck. Not only are day-to-day expenses higher, but inflation has also caused real wages to decline. Indeed, real average hourly earnings are down 3% from a year earlier, per the latest info from the U.S. Bureau of Labor Statistics. A separate report by Salary Finance found that two-thirds of working adults said they are worse off financially than they were a year ago.

With inflation eroding wage gains, more Americans are struggling financially just as the peak shopping season arrives. Approximately half of shoppers said they’ll buy fewer things due to higher prices. More consumers also plan to finance their purchases this year with credit cards and buy now, pay later loans.

The picture is bleak:

Though Democrats have gone as far as to try changing the definition of “recession” in order to skirt blame, those of us who aren’t partisan robots know that we’ve been in the midst of a recession for a while now, and unless you’ve been asleep for the past couple of years, you know why the economy is in shambles and inflation is at historic highs.

The media and the Left more broadly oscillate between blaming Putin and blaming “the pandemic.” Elizabeth Warren, she of the Pocahontas blood and not exactly the swiftest ship in Her Majesty’s fleet as far as the brain department goes, is still railing about how the inflation we’re experiencing is really just corporations abusing their market power and raising consumer prices to boost profits.

And here’s Janet Yellen,1 apparently also not the most candescent star in the intellectual Orion, who recently argued that inflation is the result of the Biden administration managing the pandemic so well that consumers felt comfortable “splurging” on goods:

Grade A bull. This is basically retrospective falsification: The conscious (or unconscious) distortion of past experiences to conform to a person’s needs in the present; lying to yourself so you don’t have to confront uncomfortable truths.

The roots of inflation and our present day economic quagmire are inextricably tied to the draconian risk-reduction measures and mandates enforced as part of the illusion that “erring on the side of caution” justified gross usurpations of power and violations of human rights. The proponents of this sort of mass hypnosis thwarted reasoned debate and healthy skepticism and cost-benefit analysis, doing their utmost to divert attention from the fact that they were coaxing the public into two years of submission to disastrous, heavy-handed policies, using fear to impose nothing less than public health authoritarianism under a regime that’s 100% responsible for the staggering costs we’re dealing with today.

You cannot just turn off the economy and turn it back on. There are consequences, and the consequences multiply the longer you keep it turned off. Nor can you flood the economy with stimulus money and expect contemporary Americans, who are fabulous consumers, to sit on it.2

“The United States has had much more inflation than almost any other advanced economy in the world,” said Jason Furman, an economist at Harvard University and former Obama administration economic adviser, who found that U.S. price increases have been consistently faster. The difference, he said, comes because “the United States’ stimulus is in a category of its own.”

A Reminder of How This All Started

Trump gave the first lockdown advisory in a March 16, 2020 presser, but it was later revealed by Washington Post reporters that he’d spent the past weekend with two functionaries serving as “advisors”: Our Lord and Savior Tony Fauci and Deborah Birx, the latter of whom was considered “the face of the Trump Administration’s pandemic response” and turned out to be a conniving little Judas. What really ended up happening is that they cajoled Trump into calling for a lockdown by using “Report 9,” a wildly alarmist epidemiological model that predicted 525% more fatalities than actually occurred.3 It’s not all that surprising that Trump needed persuading; he’s notoriously obstinate on the best of days, and he was loathe to do anything that might hurt the economy, which was thriving under him.

This isn’t meant to be a defense of the Bad Orange Man. It’s a reminder that the problems we’re dealing with today didn’t just happen; our “experts”4 weren’t caught unawares. You needn’t have been Nostradamus 2.0 to predict with a high level of certainty virtually any of the consequences that’ve manifested over the past two years. And there were many, many people just as qualified as the dunces routinely welcomed on CNN and Friends who adamantly opposed everything from the ill-conceived lockdowns to Biden’s vaccine apartheid to the masking of children, but they were shunned and censored and pilloried.

Leaders of the tech-media-Democratic party complex used the pretext of public health to seize inordinate power over the country. Any way you try to spin it, lockdowns and other risk-reduction measures — especially in the name of the utopian zero-covid idiocy — were an egregious episode of bureaucratic megalomania. The examples of state functionaries exercising power for arbitrary reasons have become too numerous to count.

The March 16, 2020 press conference was when people started losing their minds. The stock market immediately crashed 3,000 points, the largest drop ever.

Eleven days later, Congress did its thing. And when I say “thing,” I’m talking about the pandemic spending spree they embarked upon beginning with the $2.2 trillion spending bill — the Coronavirus Aid, Relief, and Economic Security (CARES) Act — that they approved without even showing up to the Capitol.

The CARES Act was a disaster. Besides the fact that it was a boat load of money our government was in no position to spend, the bill ensured the economy stayed shut down for as long as it did because states were basically incentivized to extend their lockdown mandates in order to receive the compensation the federal government was dangling like a carrot. No lockdowns? Then no lockdown allocated relief for you.

Have a looksie at this graph of total government expenditures since circa 1960:

Note the spike. You see, when Congress doles out money like this, a little something called government-secured debt is created, and that government-secured debt needs a market while the Fed’s balance sheet undergoes a seismic shift.

As we know, they didn’t stop at $2.2 trillion:

Coronavirus Aid, Relief, and Economic Security Act (CARES Act) - Included $1200 stimulus checks, March 2020

Paycheck Protection Program and Health Care Enhancement Act - April 2020

Paycheck Protection Program Flexibility Act of 2020 - June 2020

A bill to extend the authority for commitments for the paycheck protection program - July 2020

Consolidated Appropriations Act, 2021 - Included $600 stimulus checks, December 2020

American Rescue Plan Act of 2021 - Included $1400 stimulus checks, March 2021

That’s a lot of money spent to “combat” a respiratory virus with a 99% survival rate that’s endemic.

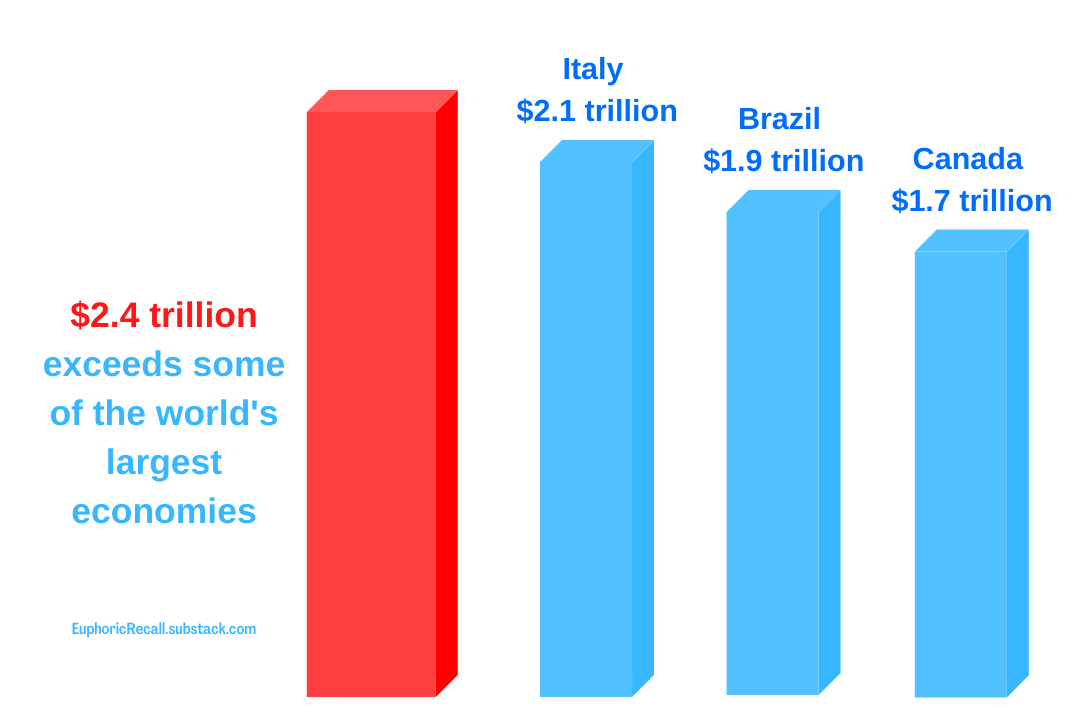

The Obama administration’s stimulus package in response to the 2008 recession was $787 billion; in a span of two months in the summer of 2021, the U.S. spent $2.4 trillion on the pandemic.

That’s more than the GDPs of all but six other nations.

By March 2022, the total spent in the name of covid was $6 trillion. And they just. Kept. Spending.

For added context, consider that in inflation-adjusted dollars, the U.S. spent about $4.1 trillion waging World War II and $114 billion in the Marshall Plan to rebuild Europe after that war. We have vastly exceeded that sum. That is astounding.

The Federal Reserve adjusted its balance sheet (it’s actually still in the process of normalizing after the spending spree) in accordance with the massive amount of stimulus money sent to households, which means debt holdings flared up, which means that debt had to be purchased with metaphorically printed dough. Thus commenced some good old-fashioned monetary devaluation in the form of printing money we didn’t have in lieu of tax.

These newly printed greenbacks resulted in a year over year total money supply jump of 26%—the largest one-year jump since 1943. The central bank’s emergency remedies have now increased the nation’s money supply by a whopping 40%. Put another way, this is four times as much new dough as what was created during the two years before the pandemic.

$600 Billion in Covid Fraud

Congress appropriated more than $5 trillion for covid relief, a mind-boggling $600 billion5 (12%) of which has been lost to fraud—easily the largest federal boondoggle in U.S. history.

As the Brownstone Institute’s James Bovard notes, policymakers acted as if foregoing standard federal fraud protections would somehow thwart covid, needlessly sacrificing security for speed. On September 22, the Labor Department inspector general estimated that covid unemployment fraud could exceed $163 billion.

“Overseas organized crime groups flooded state unemployment systems with bogus online claims, overwhelming antiquated computer software benefits in blunt-force attacks that siphoned out millions of dollars,” NBC News reported.

Russian mobsters, Chinese hackers and Nigerian scammers used stolen identities to siphon tens of billions of dollars in covid benefits, funneling the money overseas in a massive transfer of wealth from U.S. taxpayers. One Michigan man stole covid unemployment from a dozen different states. The state of Maryland detected 1.3 million fraudulent unemployment claims—equal to 20% of the state’s population.

“We’re going to get the money out, and if there’s fraud, you’ll chase it later,” was the sentiment coming out of the White House regarding covid spending, according to Michael Horowitz, Inspector General and Chair of the Pandemic Response Accountability Committee.

For PPP loans, the Small Business Administration (SBA) effectively told people, “Apply and sign and tell us that you’re really entitled to the money,” Horowitz said. Lenders did little to verify the applications because Congress required the SBA to issue explicit guidance that in the interest of getting the money out fast, lenders “will be held harmless for borrowers’ failure to comply with program criteria.” The Government Accountability Office warned of fraud risk, but the program continued under that rule.

CBS News found that PPP loans had gone to more than a thousand “ghost businesses” in Markham, Illinois. The New York Times reported that the feds even gave “loans to 342 people who said their name was ‘N/A.’”

Of course, combating fraud is difficult for federal investigators when certain politicians shamelessly use covid stimulus money to bribe voters. In the January 2021 Georgia runoff race for U.S. Senate, Democratic candidate Raphael Warnock distributed fliers declaring, “Want a $2,000 Check? Vote Warnock.” Indeed, Biden himself told Georgia voters they would get the money—but only if Warnock won. He did. It sealed Democratic control of the Senate and greenlit trillions of dollars of additional Biden administration spending.

And as we all know well, Biden perpetrated the single greatest covid fraud on August 24, when he invoked the pandemic “emergency” to justify canceling $400 billion in student loans—even though Biden told 60 Minutes a couple weeks later that the pandemic was over, thereby invalidating his justification for loan forgiveness. This was another flagrant ploy to purchase Democratic votes in the midterms.

Do not forget that all the asinine, divisive, and blatantly unscientific policies and mandates that contributed to this mess were not bipartisan in nature, and that one side of the political spectrum is largely responsible. I say this not out of vindictiveness, but because it’s beginning to feel like far too many people are letting the lines of causality fade in the fog of the past two years. We might never see accountability, but we can make sure not to forget, lest it should happen again.

She also declared that efforts by Apple and Google to remove Twitter from their app stores would be a “kind of control that I think is needed.”

The pandemic merely accelerated a trend that had been advancing for years: the shift toward online shopping. From April to June 2020, as the first wave of the virus spread, Amazon sold 57% more items than it had the previous year.

The reason it’s so outrageous that Fauci and Birx used this model to convince Trump to impose lockdowns is because it was created by Neil Ferguson, an epidemiologist from Imperial College London whom Elon Musk once described (accurately) as an “utter tool who does absurdly fake science.” Ferguson’s models have been so wrong, so often, that other epidemiologists refer to him as “Master of Disaster.” He would later admit that his Report 9 model was based on undocumented, 13-year-old computer code intended for an influenza pandemic—which he declined to release so other scientists could check his results. There’s simply no way that Fauci wasn’t aware of Ferguson’s reputation, and yet he still used Report 9 to essentially scare Trump into imposing lockdowns.

Don’t let anyone ever front their fancy degrees in your face and claim the mantle of expertise. Trust in the intellectual integrity of the individual is earned by the superiority of their arguments based on their scholarship.

A sum greater than the $579 billion in federal funds included in Biden’s massive 10-year infrastructure spending plan.

the “kind of control that I think is needed” !?!?!?!?!

Fascist says what??

Let’s not forget that Neil Ferguson had previously bungled a forecast of ...had to look it up and oh, it’s more than one!

John Fund writes:

[Imperial College epidemiologist Neil] Ferguson was behind the disputed research that sparked the mass culling of eleven million sheep and cattle during the 2001 outbreak of foot-and-mouth disease. He also predicted that up to 150,000 people could die. There were fewer than 200 deaths. . . .

In 2002, Ferguson predicted that up to 50,000 people would likely die from exposure to BSE (mad cow disease) in beef. In the U.K., there were only 177 deaths from BSE.

In 2005, Ferguson predicted that up to 150 million people could be killed from bird flu. In the end, only 282 people died worldwide from the disease between 2003 and 2009.

In 2009, a government estimate, based on Ferguson’s advice, said a “reasonable worst-case scenario” was that the swine flu would lead to 65,000 British deaths. In the end, swine flu killed 457 people in the U.K.