Je Me Souviens: I Remember

Inflation didn't just happen.

Thank you so much for reading Euphoric Recall. To receive new posts and support my work, please consider becoming a free or paying subscriber.

It's the economy, stupid. The covid hysterics may still abound, but the pandemic has receded as a top priority in many voters’ minds. Polls show that the majority of Americans are much more concerned with rising inflation, and for good reason. Gas is so expensive here in Los Angeles that I shaved my head rather than drive up Venice Blvd to get my hair cut—and not because it's an issue of affordability, but because there's some innate part of my being that steadfastly refuses to go along with the vaudeville sketch we now find ourselves in like a bunch of one-dimensional marionettes. I'm not paying upwards of $8 a gallon to drive to get a haircut that used to be like $15 but is now closer to $30. Call it principle, call it parsimony. I don't care. There’s no denying that some of the prices we’re seeing here in the U.S. are the highest ever.

Remember

Putin is not the reason you’re paying an insane amount of dough for a tank of gas. He deserves the same fate as Saddam, this is true, and there’ve been all kinds of dire prognostications about imminent collateral damage from the (frankly, very heartening) globally-coordinated campaign to bury Russia, but we at this here letter of news do our utmost to side with the harder facts over the easier fictions. Putin’s not the culprit. He’s a compounder.

Nor is the pandemic to blame for our economic quagmire. It is not “because of covid.”

The roots of inflation are inextricably, indisputably tied to the draconian risk-reduction measures and mandates enforced to foster the illusion that “erring on the side of caution” justified gross usurpations of power and violations of human rights. The proponents of this sort of mass hypnosis thwarted reasoned debate and healthy skepticism and any and all cost-benefit analysis, doing their utmost to divert attention from the fact that they were coaxing the public into two years of submission to disastrous, heavy-handed policies whilst simultaneously using fear to impose nothing less than public health authoritarianism, a regime that’s 100% responsible for the staggering costs we’re dealing with today. And it's more than a little upsetting that most covid hysterics still refuse to entertain the possibility that their fanatical interventions — which have boosted depression, suicide, alcohol abuse, drug overdoses, domestic violence and undiagnosed cancer — are a net negative in public health.

Do not forget. Do not let them memory hole the lockdowns and their subsequent prolongation of the irrational response to the virus—a response married with propaganda in service to the whatever-it-takes-to-defeat-Trump zealots who politicized the pandemic to such an acute degree that (as but one example) we now know the lab-leak hypothesis was dismissed as a xenophobic conspiracy theory in a coordinated, obsessive effort amongst port-side elites and mainstream media outlets to undermine a sitting president, in this case simply because he suggested the virus could’ve very well come from the Wuhan Institute of Virology.

Do not forget that all the asinine and blatantly unscientific mitigation measures were not bipartisan in nature, and that one side of the political spectrum is largely responsible. I say this not as a conservative or a republican; as I’ve said before, I’m not a partisan and could really give two shits who’s in the Oval Office so long as it’s what’s best for the country. I say this because it’s beginning to seem like far too many people are letting the lines of causality fade in the fog of the past two years.

And lastly, do not forget that the burdens of lockdown policies were placed on those least equipped and least prepared to handle them. “The price is worth it,” said the people who didn’t have to pay it—the fragile Zoom class, the me-first Blue Falcons.

“Inflation Is Taxation Without Legislation”

Milton Friedman, arguably one of the world's foremost economists, said that.

You cannot just turn off the economy and turn it back on. There are consequences, and the consequences multiply the longer you keep it turned off.

Money is losing it’s value. That, simply put, is what’s happening, and even though your salaries and wages might include cost-of-living increases and what not, it doesn’t matter because the purchasing power of your money is depreciating. It’s not “transitory.” Tell that to the impoverished. Better yet, tell that to the financially disciplined folks who built up a considerable nest egg over the course of however many years while others indulged in profligacy only to be punished for their frugality.

Yours truly is not an economist, or an expert, or a financial sage; I’m something of a nerd, a dude who reads a lot about a lot of stuff, and often times a lot of a lot of said stuff involves psychology in one way or another. Like the phenomenon of risk-aversion, for instance. And man, there’s a plenitude of Americans who’re risk averse in the extreme. I remain flummoxed by this pandemic-induced revelation more so than any other. And honestly, I think we've long since passed the point at which this chariness seems more like cowardice. America’s plight originated from unscientific, ill-advised pandemic policies supported by zealots, the hysterics who proudly serve as megaphones for overreaching public health officials when they're not busy ostracizing others — in many cases severing lifelong friendships and even excommunicating family members, which is still amazing to me — in retaliation for not falling in line.

The number of folks who prostrated themselves before the altar of self-preservation, the most basic and tyrannical of all instincts, due to the inability to cope with uncertainty, adversity, and fear—their abundance does not augur well. Perhaps some reflection is in order.

And so but yes, risk aversion supplants consumer confidence during times of unease and uncertainty, just as it did in March 2020 when the pace at which money normally changes hands collapsed because people were understandably fearful of what the imminent future had in store. I couldn’t even do my laundry for God’s sake; nobody would give me any damn quarters because they either didn’t have enough quarters in the register or they’d specifically been told that under no circumstances were they to give quarters in the register to any peasants asking for quarters.

The widespread savings that naturally follows the supplanting of consumer confidence with risk-aversion, that’s not necessarily a bad thing. Normally, a society-wide boost in savings makes economic recovery possible; when the crisis dissipates, deferred consumption in the form of savings becomes the basis of investment in capital that then becomes the basis of rebuilding. (BUILD BACK BETTER!)

And boy did savings skyrocket at the beginning of the pandemic. Stratospheric: 7% to 33%. Household savings soared 120%. Corporate and business savings also spiked, as they managed to sock away a clean $600 billion.

A Quick Look Back At How This Started

Trump gave the first lockdown advisory in a March 16, 2020 presser, but it was later revealed by Washington Post reporters that he’d spent that weekend with two functionaries serving as “advisors”: Our Lord and Savior Tony Fauci and Deborah Birx, the latter of whom was considered “the face of the Trump Administration’s pandemic response.” What really ended up happening is that they cajoled Trump into calling for a lockdown. Not all that surprising that Trump needed persuading; the guy is notoriously obstinate and obdurate on the best of days, and he was loathe to do anything that might hurt the economy.

This isn’t necessarily meant to be a defense of Trump. It’s a reminder that the problems we’re dealing with today didn't just happen; our “experts” weren't caught unawares. You needn’t have been Nostradamus 2.0 to predict with a high level of certainty virtually any of the consequences that’ve manifested over the past two years. And there were many, many people just as qualified as the dunces routinely welcomed on CNN and friends who adamantly opposed everything from the ill-conceived lockdowns to Biden’s vaccine apartheid to the masking of children, but they were shunned and censored and pilloried.

A handful of people used the pretext of public health to seize inordinate power over the country, and these actors have since revealed themselves to be Democratic partisans. Make of that what you will. Any way you try to spin it, lockdowns and other mitigation measures — especially in the name of the utopian zero-covid foolishness — were an egregious example of bureaucratic megalomania. The examples of state functionaries exercising power for arbitrary reasons have become too numerous to count.

Welp.

The March 16, 2020 press conference was when people started to lose their minds. The stock market immediately crashed 3,000 points, the largest drop ever.

Eleven days later, Congress did its thing. And when I say “thing,” I’m talking about the pandemic spending spree they embarked on beginning with the $2.2 trillion spending bill — the Coronavirus Aid, Relief, and Economic Security (CARES) Act — that they approved without even showing up to the Capitol.

The CARES Act was a disaster. Besides the fact that it was a shit ton of money our government was in no position to spend, the bill ensured the economy stayed shut down for as long as it did because states were basically incentivized to extend their lockdown mandates in order to receive the compensation the federal government was dangling like a carrot. No lockdowns? Then no lockdown allocated relief for you.

Have a looksie at this graph of total government expenditures since circa 1960:

Note the ECG spike. You see, when Congress doles out money like this, a little something called government-secured debt is created, and that government-secured debt needs a market while the Fed’s balance sheet undergoes a seismic shift.

As we know, they didn't stop at $2.2 trillion:

Coronavirus Aid, Relief, and Economic Security Act (CARES Act) - Included $1200 stimulus checks, March 2020

Paycheck Protection Program and Health Care Enhancement Act - April 2020

Paycheck Protection Program Flexibility Act of 2020 - June 2020

A bill to extend the authority for commitments for the paycheck protection program - July 2020

Consolidated Appropriations Act, 2021 - Included $600 stimulus checks, December 2020

American Rescue Plan Act of 2021 - Included $1400 stimulus checks, March 2021

That’s a lot of money spent to “combat” an endemic respiratory virus with a 99% survival rate that hasn’t gone anywhere because it is endemic.

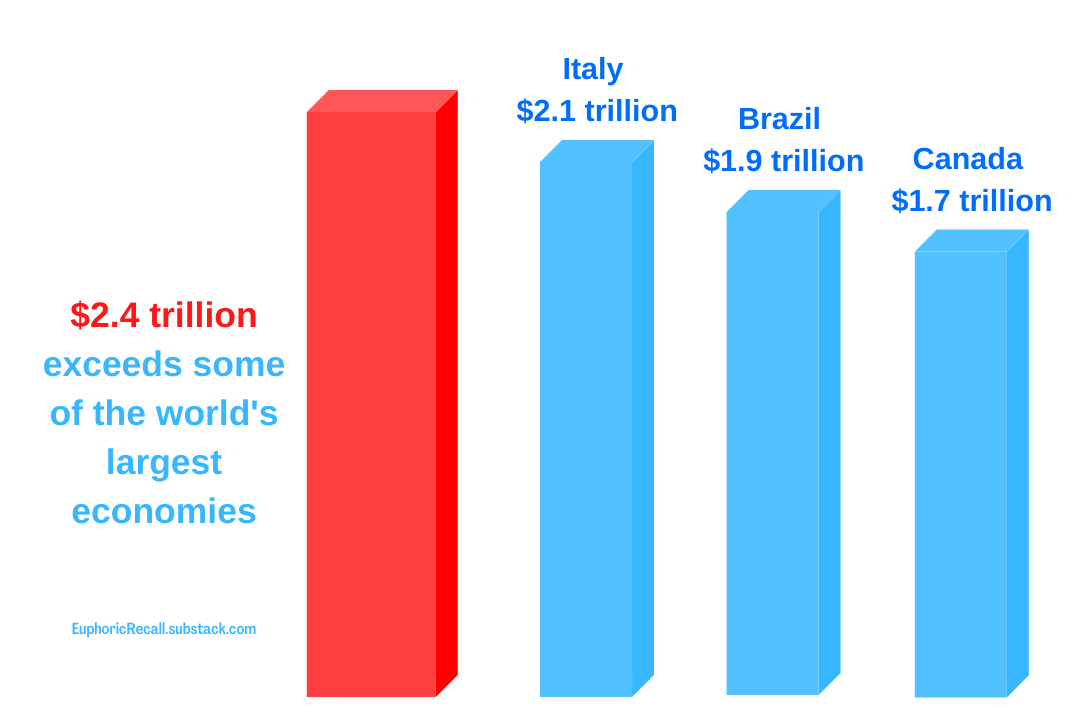

The Obama administration’s stimulus package to respond to the 2008 recession was $787 billion. In a span of two months in the summer of 2021, the U.S. spent $2.4 trillion on the pandemic.

That's more than the GDPs of all but six other nations.

By November 2021, the U.S. had passed $5.9 trillion in legislation to pay for our “pandemic response.” As of March 2022, the total spent in the name of covid was $6 trillion. And this past Monday (April 4th), Congress said what the hell, might as well throw another $10 billion at it.

For added context, consider that in inflation-adjusted dollars, the U.S. spent about $4.1 trillion waging World War II and $114 billion in the Marshall Plan to rebuild Europe after that war.

The Federal Reserve adjusted its balance sheet (it’s actually still in the process of normalizing after the spending spree) in accordance with the massive amount of money sent to households, which means debt holdings flared up, which means that debt had to be purchased with metaphorically printed dough. Thus commenced some good old-fashioned monetary devaluation in the form of printing money we don’t have in lieu of tax.

These newly printed greenbacks resulted in a year over year M2 jump of 26%—the largest one-year jump since 1943. The central bank’s emergency remedies have now increased the nation’s money supply by a whopping 40%. Put another way, this is four times as much new dough as what was created during the two years before the pandemic.

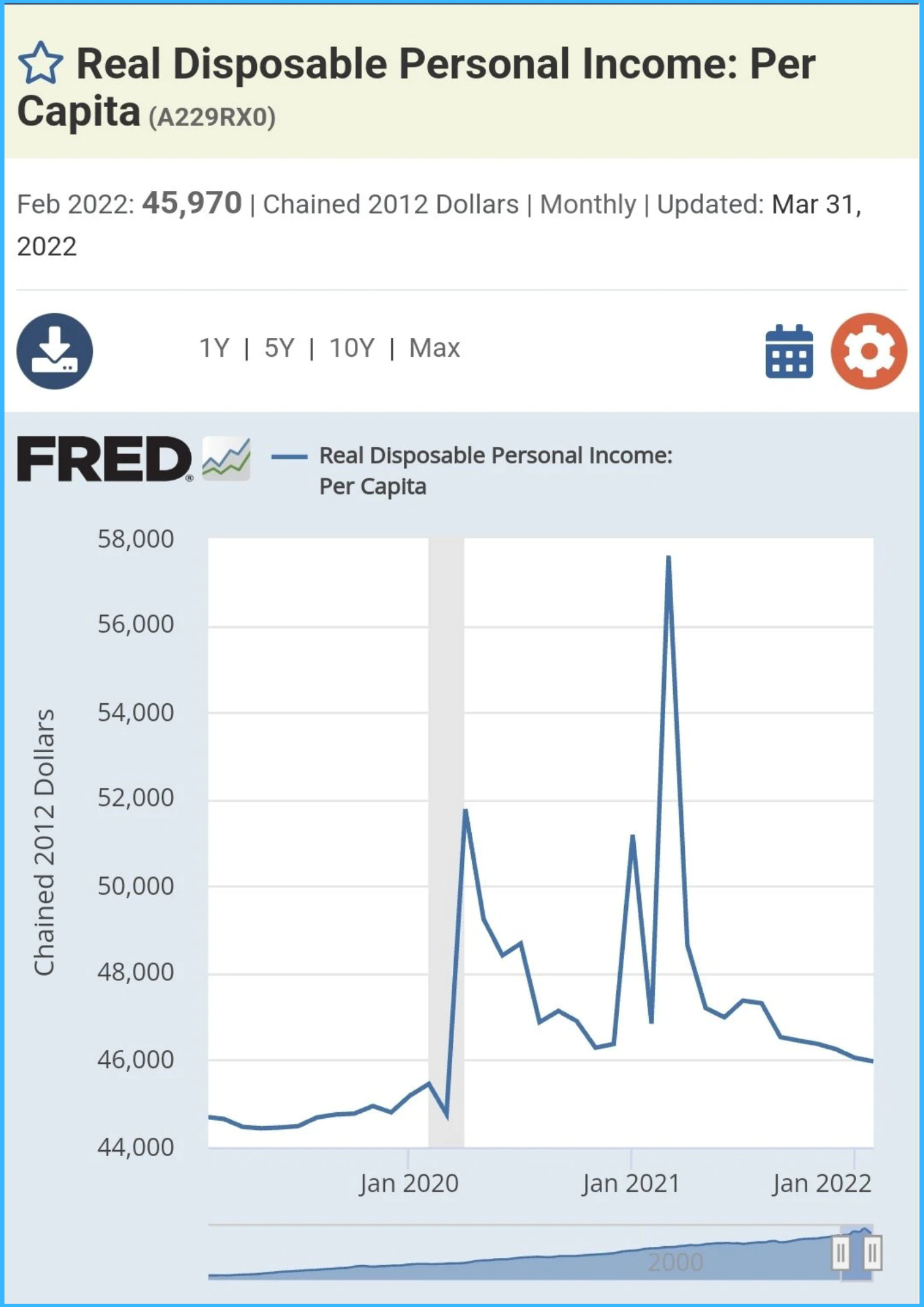

I’m sure you can recall that as this was all going down in Washington there were quite a few folks expressing alarm. By and large though, appeasement kicked in once people started seeing checks dropped in their bank accounts courtesy of Uncle Sam.

Unfortunately, the purchasing power of these checks diminished in rapid fashion. According to the Brownstone Institute, a nonprofit organization founded in response to the pandemic, $1 saved last year is only worth $0.92 today and will be worth $0.84 by year’s end. Not cool.

The psychology of money suggests that the general outlook on saving could change in response to this inflation mess: If it doesn’t seem to make much sense to hang on to $10 now in the hope that it’ll appreciate, then the alternative is to “live in the moment.” Profligacy. And if that trend takes hold, devaluation will speed up.

Freefall

I want to stress how silly it was to think the “destruction of spending” was imminent. Contemporary Americans are fabulous consumers. Easily the most hedonistic people to ever walk the face of the earth. The pandemic merely accelerated a trend that had been advancing for years: the shift toward online shopping. From April to June 2020, as the first wave of the virus spread, Amazon sold 57% more items than it had the previous year

Makes sense.

The boys and I can't splurge on libation-intensive recreational pursuits anymore—indefinitely!? Fine. Then I'm gonna self-isolate and adopt eccentric agoraphobic behaviors and dive headfirst into some retail therapy on the interwebs and buy a squirrel farm and when the squirrels don't need tending to I'll convince myself that Trump is the second coming of Christ and Hillary Clinton did 9/11.

The Great Supply Chain Fiasco™

To be sure, the stimulus payments alone didn’t bring about our economic quandary.

The federal government’s fateful decision to grace American households with stimulus cash specifically printed to be spent was not timely. With cash burning holes in pockets, American demand collided with a supply chain too fragile to handle the forthcoming supercharged sales. Folks wanted to buy goods that companies couldn't supply, and as supply dwindled, transportation costs catapulted.

Thus it was that the Chinese Container Calamity™ and Ticked-off Trucker Tumult™ merged to give us The Great Supply Chain Fiasco™.

As demand increased, a wave of factory goods overwhelmed U.S. ports. Pandemic labor shortages worsened the situation because container ships took longer to unload, which inevitably led to even more port congestion. Surging orders outstripped the availability of shipping containers, causing the cost of shipping a single container from Shanghai to Los Angeles to skyrocket tenfold, reaching highs of more than $20,000 per 40-foot box. As if all this weren’t bad enough, many of the ships that’d been waiting to unload were forced to return to their port of origin due to covid protocols in good old Los Angeles.

Think about that for a moment. Most crossings of the Pacific Ocean take anywhere from 15 to 30 days. Imagine the global supply chain complications caused by these “erring on the side of caution” policies. NINENTY PERCENT (90%!) of international trade depends on shipping.

The container situation was a gordian knot the likes of which had never been seen before in the history of transportation. It was transit and freightage mayhem to the nth degree and it kept getting worse. Thousands of these technicolor intermodals piled up on docks unclaimed due to a shortage of truck drivers, the indispensable link between cargo and warehouses. Truckers had been dwindling in numbers years before the pandemic because of poor wages and working conditions. Long-haulers move around 71% of the U.S. economy's products across the country. Kind of important.

When the Biden vaccine apartheid was announced it did not go over well with the trucking community. You know things are bad when even the Canadian long-haulers lose it and Trudeau morphs into the most benign-looking dictator of all time. Canadians are a legendarily docile breed. They had 743 murders last year, a 15-year high. Meanwhile, in America, the city of Chicago had “at least 800.”

Good piece, food for thought. Je Me Souviens is the slogan of the province of Quebec, it’s on their license plate. It’s taken to mean that they will remember their French heritage within Anglo Canada and North America at large. A secondary meaning is thought to be, they remember that they are a conquered people.